We are excited to share with you the Senti-Bot results for July 2023. The SentiStocks team delivers a performance-focused tool in the rapidly changing world of cryptocurrencies.

July was a breakthrough month for Senti-Bot, which now runs on the CryptoPulse strategy, allowing sell/buy and prediction operations to take place every 15 minutes, instead of every full hour as before.

Table of Contents

Senti-Bot results

We have been systematically monitoring the performance of the CryptoPulse BTCUSD strategy since January. The analysis for the period January-July for closed positions clearly shows that the performance of the CryptoPulse BTCUSDT strategy (+89%) is significantly higher than that achieved with breeding (+77%).

Similarly, an analysis of the monthly results reveals the superiority of the CryptoPulse BTCUSDT strategy over breeding. This strategy successfully protected capital from the declines experienced with breeding in May (-6.9%) and July (-4.1%).

Results of the first commercial customer

In addition, we present the results of the bot for our first commercial client, which started in September 2022. The bot then ran on the Conservative strategy until June 2023, and since 1 July it has already been using the CryptoPulse strategy.

At the end of July, the profitability of the strategy involving breeding was slightly higher than the bot’s efficiency. However, it should be noted that over the course of these eleven months, in addition to generating profits, the bot successfully protected the investor from the spikes in the BTC price that occurred in November 2022 and May and July 2023.

In addition, the protective nature of the bot’s operation (regardless of the strategy used) is attested to by the value of the max drawdown rate of -10% for the analyzed period with -29% for breeding.

Senti-Bot performance indicators

From the beginning, we emphasise that Senti-Bot’s effectiveness should be considered over a period of more than one or two months. In assessing the effectiveness of the tool, important elements are the measurement of indicators such as:

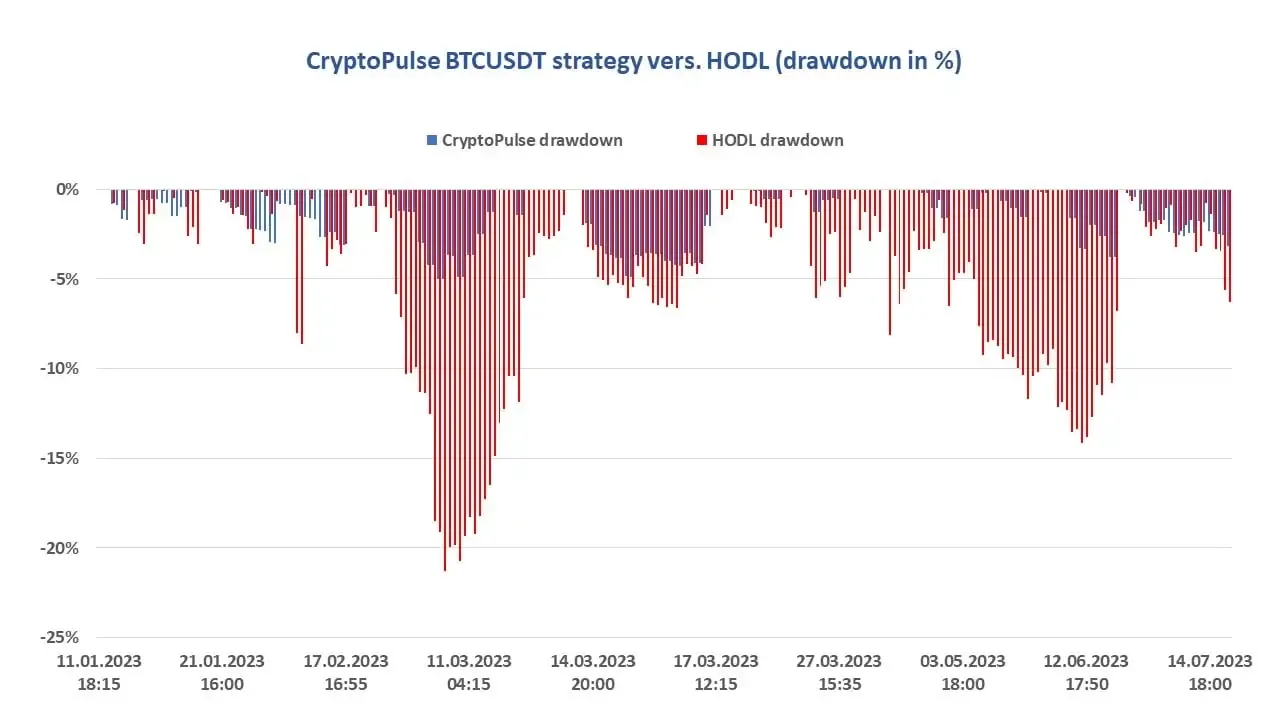

Drawdown

A drawdown is simply the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous level of capital with its current value.

As specified in the chart below, this strategy protects your capital even more effectively from significant losses. The maximum drawdown for the new CryptoPulse strategy was -5%, while it was -21% when breeding.

Profit Factor

Another measure is the Profit Factor. This ratio, used to evaluate active investment strategies. It is defined as the sum of the value of all trades with a profit, divided by the sum of the value of all trades closed with a loss. It is assumed that its value above 1.50 is considered good enough and above 2.0 is considered to be perfect.

SentiBot’s performance from January to July 2023 shows that the average profit from closed positions was (+1.87%), while the average loss was much lower (-0.23%).

The Profit Factor for Senti-Bot is 2.56 at the end of July 2023, confirming SentiBot’s high performance. (see table below).

Thank you for your trust and encourage you to follow Senti-Bot’s performance in the coming months!

SentiStockS Team