We have chosen the worst possible moment to start forecasting cryptocurrency prices, namely the Bitcoin forecast. This largest and perhaps most important currency in the world of crypto has never been particularly stable. The situation related with the COVID-19 spread, on the other hand, increased only the exchange rate fluctuations. The drop from over 9,000 USD to just over 4,000 USD in such a short period was, even in this world, unprecedented. But who could have foreseen it. And besides, we once had to start 🙂.

How do we predict the changes in exchange rates? We have already revealed the secret in the read “Sentiment or emotions on the crypto stock market?“. We decided to publish on our Facebook fan page the forecast course every day. By doing it, we wanted to show the effectiveness of Sentimenti predictions. That is why we created a Sentistock group on Sentimenti’s Facebook profile in early March. At the same time, we had the last internal arrangements concerning the scope and form of publication. The first premiere entry appeared on March 16th and it continues until today.

The standard daily signal contains the following data:

- Fixed average price measured from 24 closing prices, calculated each time for a full hour, fixed at 16:00 on the day of publication;

- Average daily rate of exchange, calculated until 16:00 the following day;

- Number of mentions taken into account.

In the comments section we publish information about the accuracy of our prediction.

Well, this is probably what interests you most. There you go then:

How did our effectiveness work out – the Bitcoin forecast

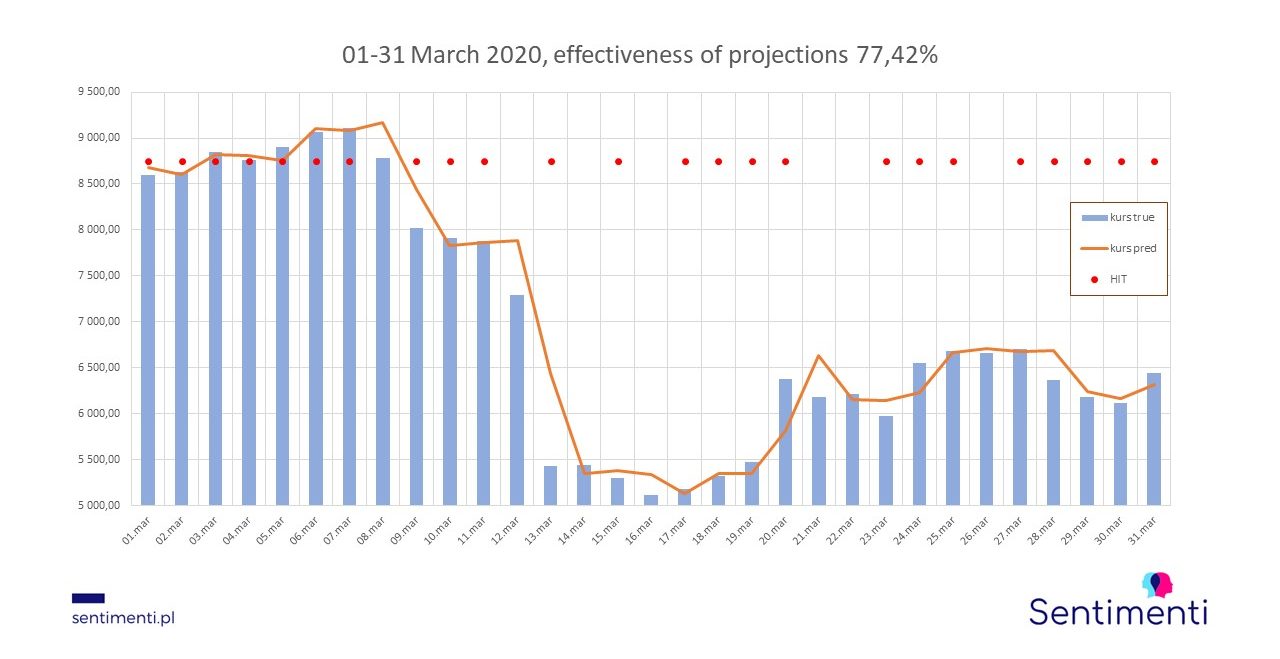

For the whole of March 2020, the effectiveness of the trend change prediction was 77.42%. For the shorter period, which was published on the Facebook group (i.e. since 16 March), the effectiveness was 75%.

What data do we analyse before we make a prediction?

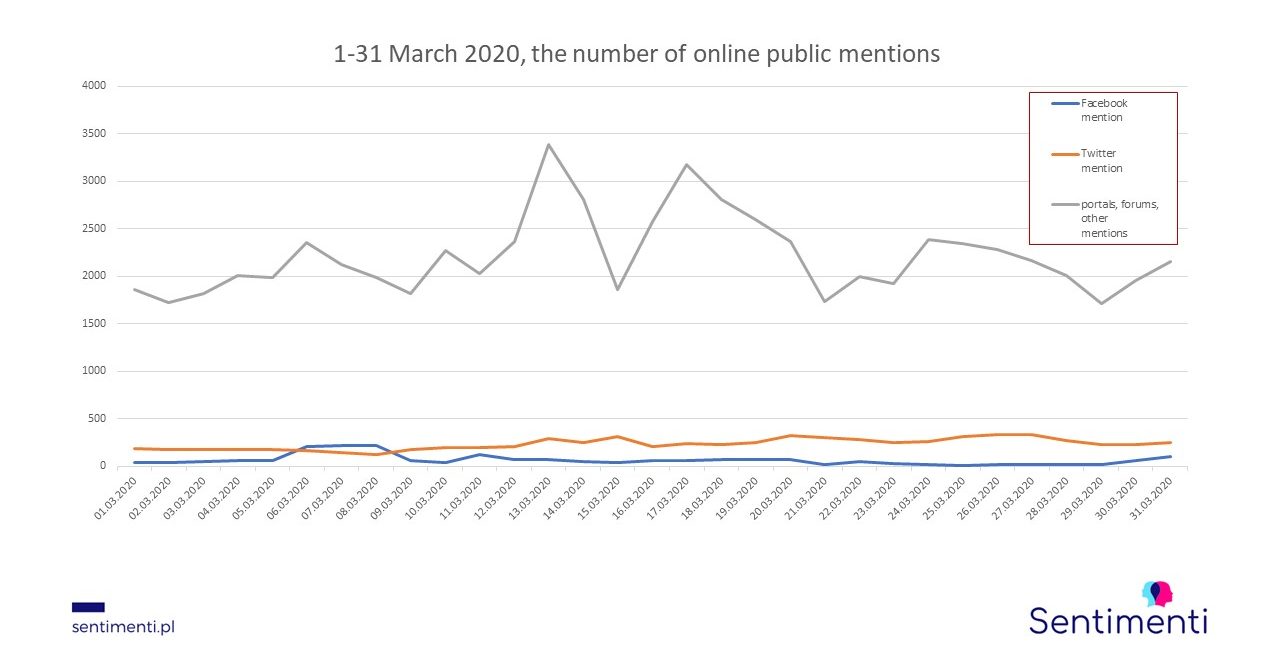

Concluding, throughout March we collected 77 923 mentions from such sources as: Facebook, Twitter, internet forums, websites and blogs. The daily average analysed by us is about 2 500 mentions. Any extra reflections? There is one: Twitter is the individual medium that stands out.

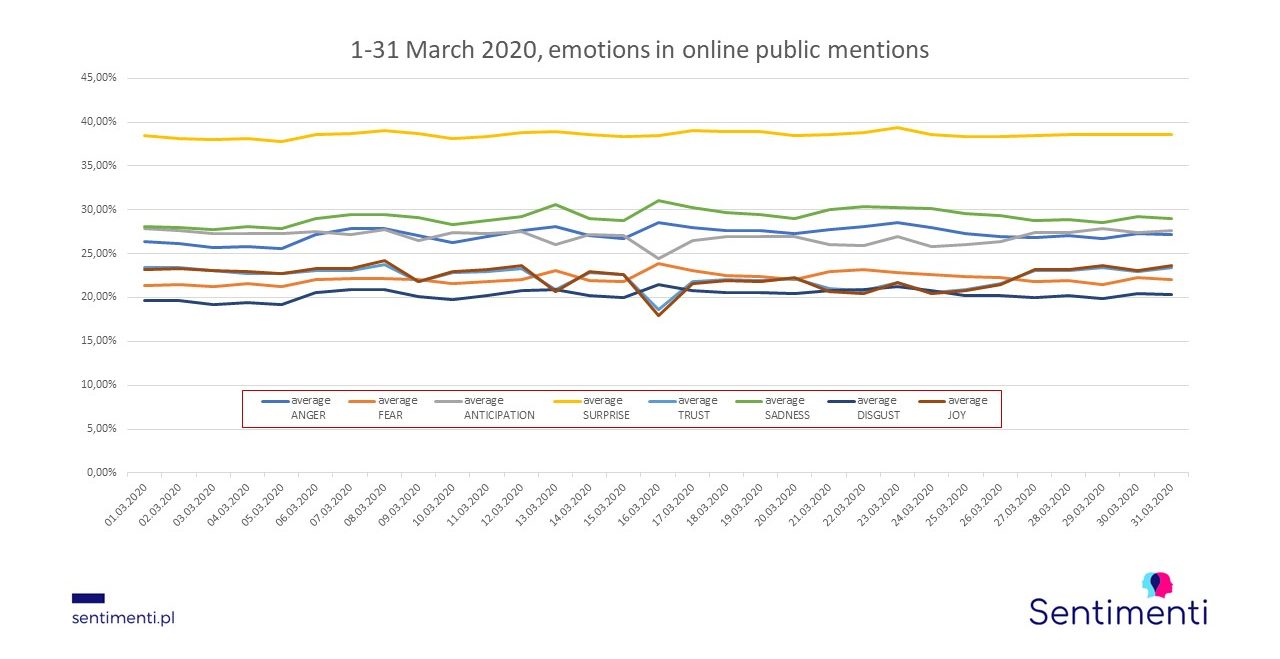

Finally, the collected data sets up the material that is analyzed by Sentitool, by the most important part of our prediction model, the so-called regresor (analyzer of 8 emotions, positive and negative sentiment and arousal). Those more interested are referred to a few articles on our blog.

Probably April will turn out to be more demanding. Moreover, the situation around COVID-19 spreading around will be felt also in cryptocurrency courses. Any way, we will certainly keep you informed about it! 🙂